HR NEWSLETTER MAY 2020

MCO Extended to Phase 4: What challenges do SMEs face?

SMALL and medium enterprises (SMEs) are the lifeblood of the economy. In Malaysia, almost 98% of all businesses are SMEs and they contribute to 40% of the nation’s gross domestic product (GDP) and employ around 70% of the workforce.

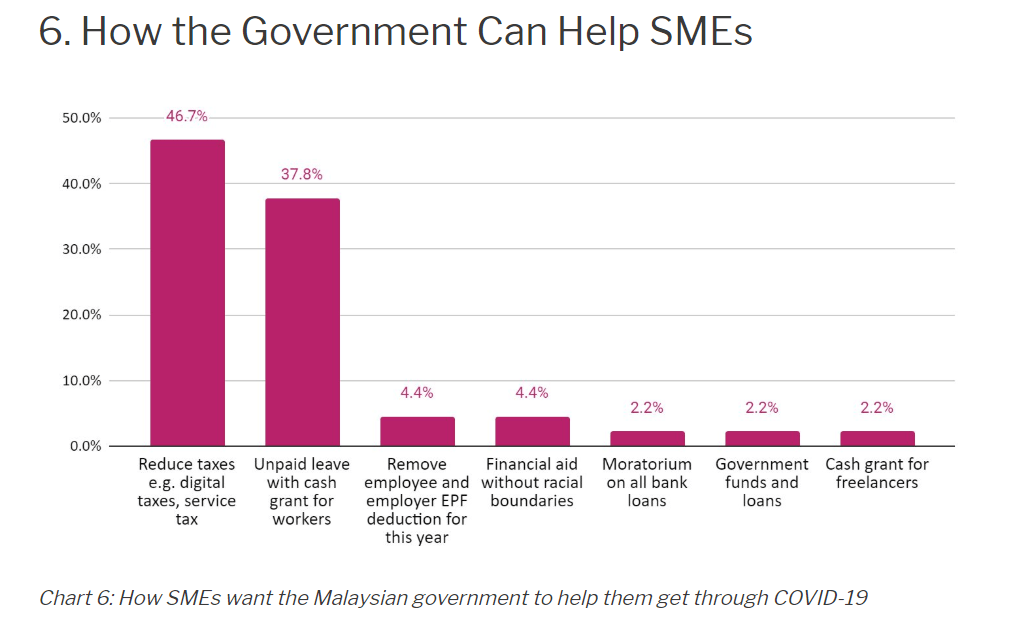

The most hard-hit industry by the pandemic and the Movement Control Order (MCO) are the small and medium enterprises (SMEs). They are being challenged to rethink how day-to-day activities are conducted due to the new normal. Most of us have to change the way we work and business operation to consider other measures to keep the business afloat.

Challenges

In a move to ease the economic impact on SMEs, FMM said given the inability of businesses to sustain their operations with the current workforce, some of the likely cost-cutting measures that employers would undertake in the next three to six months in order to preserve employment include freezing headcount (67% of respondents), instituting unpaid leave (59%), removal of some non-contractual allowances and benefits (59%), forced annual leave (59%), reduction on work days per week (39%), reduction in some benefits agreed in the collective agreement for unionised companies (34%) and reduction in working hours per day (29%).

“Majority of companies in unionised environment (62%) are unable to negotiate to implement cost- cutting measures to save jobs, resulting in 48% of these unionised companies having to resort to retrenchment or layoff in the event that the unions refuse to accept the cost-cutting measures such as reduction in working days or hours,” FMM president Tan Sri Soh Thian Lai said in the same statement yesterday.

The government has stepped in to help employers with a RM10 billion assistance package aimed at SMEs to subsidise some wages.

“The government offers a good lifeline through the wage subsidy programme, but the impact could remain beyond three months and when the time comes, the government needs to relook at the package and see if employers can be assisted further,” he said.

According to the Finance Ministry, for the employee retention programme, as of April 12, 6,900 business owners have submitted applications for some 47,000 workers.

“Companies have to consider the best solution to ensure employees’ retention because it will be a primary concern post-MCO in order for a company to operate efficiently.

“Despite the crisis, companies need to look at post-recovery strategies, which also involves having the ability of the right and skilful people to operate,” he said. Palaniappan said with the current situation, companies are exploring various options to sustain their business.

“One of an organisation's biggest overheads is that of salaries and wages. And yet, if these are not processed on time, it can negatively impact staff morale and create the impression that the company is not financially stable.”

Payroll Outsourcing Services

For SMEs, payroll is normally the responsibility of an accountant but even administrators can sometimes be roped in to do the job, even though they have no expertise in the matter. This is where the value of outsourcing your payroll comes in.

If Employee Retrenchment is one of the options, Choosing Payroll Outsourcing Services to reduce the cost of operating is wise.

When should you outsource?

• Cost efficiency & cost savings are the major reasons

• Staffing problems, retraining new staff, confidentiality, accuracy and paying on time.

• If you want to grow your business but are not aware of ongoing legislative changes that could pose a risk to your company, then it is better to get a professional to assist.

• Accountants and bookkeepers are not HR specialists and do not keep up with the latest compliance . Outsource your payroll, allows them to focus on their core duties and not bogged down by legislative complexities.

• By allowing your team to access data from home to process payroll will expose your company to higher security risks if no proper IT compliance is administered.

The advantages of outsourcing your payroll

One of the most obvious benefits of going the outsourcing route is freeing up your resources to focus on your core strategic objectives. This ensures you to provide quality of service to your clients and enjoy costs control while an experienced partner takes care of your payroll.

Here are a few other benefits:

• Reduce operating costs.

• Statutory compliance and consistent service delivery.

• Access to the latest technology, as well as skilled and dedicated payroll resources.

• Available Remote from home. Hence it is no affect the payroll pay-out.

• One to One consult about your payroll inquiry.

• Access to a secure, risk-free and confidential payroll environment.

• Increased flexibility and responsiveness.

• Streamlined internal processes and procedures.

DID YOU KNOW: LHDN Extension on Important Deadline

IRB will notify through email registered with them. Taxpayer do not need to pay the deferred payments. The balance of tax (if any) has to be settled upon the submission of the income tax return.

Stay Safe. Together we can fight Covid-19.